by Australian Finance Planning | Aug 29, 2014 | Loan Rate

In Fixed Loan Rate scheme, the interest rate that is applied to your principal loan is “fixed” for the entire agreed upon period of your loan. Opposite to the Variable Loan Rate, where interest rate applied can change over time, you will be required to consider multiple factors from time-to-time. In fact, if we refer to the post of an independent financial portal – Financial Web, factors such as economic status, inflation, actions and mandates of the government, international forces, US financial system and exchange rates of US dollar are the things you need to watch out for since these affects directly the amount you will be paying regularly.

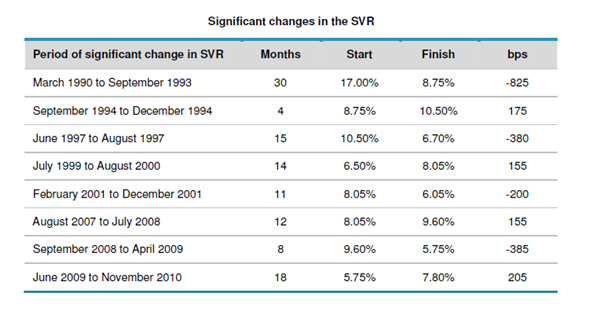

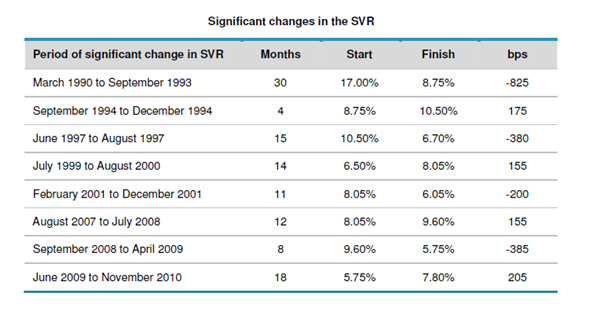

To understand this better, let’s take a look at the 2012 report of Australian Bankers Association (ABA), where they presented the timeline of interest rates in their report. This table shows the significant changes in Standard Variable Rates (SVR), specifically for home loan, on a set of month’s basis:

As you can see there are only a few months at certain periods where interest rates for home loan is really low. March 1990 to September 1993 – there was a drop of -825bps but it only sustained for 4 months. After which it went back to 10.50%. June 1997 to August 1997, for 15 years interest rate is at 10.50% which went down to 6.70% but in the span of 14 months it went back to 8.05%. The cycle continues to go up and down up until November 2010 where there was again an increase of 205bps with interest rates now at 7.80%.

Now if we are going to take a look at the current interest rates of banks for home loans you can secure a 5 year fixed loan from 4.89% – 5%. Putting this data together with the one presented in the report of ABA, we are at times now when interest rates are at its lowest point. One thing to consider is that properties have cycles and trends. For further understanding of this you can refer to the articles of Australian Property Agency – Property Cycles and Property Cycles and Trends . If you view these pages combining with the report of ABA, there is a big probability that the next movement of home interest rates is going up.

This is where the Fixed Loan Rate is at its best.

Technically this gives you the advantage to “lock” or “fix” the interest rate you will be paying for the next 5 years while the rate is still at its lowest point. Furthermore, home loan interest rates are now at 4.5% – 5% which has never happened so far for the past 23 years – based on the report of ABA.

Therefore, it is highly recommended that if you are planning to invest in a home, now is the best time to do it.Locking it in 5 years’ time, this will give you the peace of mind that no matter how high interest rates may increase for the next few months, you will be “immune” to such events and getting your home at the lowest possible interest rate. This also assures you that you are really getting every cent of your hard earned money.

Reference:

http://info.finweb.com/banking-credit/factors-influencing-interest-rates.html#axzz3ILimUeWN

http://smallbusiness.chron.com/variable-vs-fixed-interest-rate-5024.html

http://www.ratecity.com.au/home-loans/fixed-rate

http://www.bankers.asn.au/Banks-in-Australia/Facts—Figures/Standard-Variable-Home-Loan-Interest-Rates-1990-2010

by Australian Finance Planning | Aug 28, 2014 | Interest Rate

LOWEST INTEREST RATES EVER

SAVE MONEY NOW!!

Historically lowest interest rates from the RBA for the past 12 months have created intense competition from all Banks. Now is the time to check you loans and re-negotiate the interest rate you are currently paying.

Banks have a nominal advertised Standard Variable interest rate but will now negotiate 0.7% to 1.2% discounts off the Standard Variable rate depending on loan size and the strength of the Borrower.

You still need to find a loan that best suits your particular objectives, needs and be flexible as the lowest interest rate loan may be inflexible with hidden costs and charges for any changes. The best loan feature you need is a full Offset account to reduce interest costs.

Variable rates are flexible and great when interest rates fall but can be stressful and more expensive when interest rates increase.

Variable rates are flexible and great when interest rates fall but can be stressful and more expensive when interest rates increase.

Now is a great time to fix your interest rates for 3 years at 4.65% and for 5 years at 4.99%. The key to fixing interest rates is timing as you want to fix interest rates about 0.5% from the lowest variable interest rates as the market increases longer term interest rates before we hit the lowest variable rate.

Fixed interest rates give you better cashflow certainty and less debt stress when variable interest rates start to go up again. Banks often use fear to get you to fix interest rates just before the top of the interest rate cycle to lock in extra profits.

If you are uncertain, you can always split your loan into part fixed and part variable interest rates.

Contact your Mortgage Broker now to refinance or negotiate a better deal on your loans.

by Australian Finance Planning | Aug 27, 2014 | Business, Finance, Interest Rate

There have been lots of speculation around if the interest rates are going to stay down and whether we will even see them this low again in our lifetimes. Currently at the time of this blog the RBA has held its cash rate steady for 15 months now at 2.5%. The rate has remain unchanged since August 2013, but according to a survey of 12 economists all saying they have predicted a rate hike in 2015.

So in the next 12 months interest rate are going to go up and you’re not going to be able to take advantage of the incredibly low interest rates the banks are offering. Refinancing existing loans using a fixed rate is one of the most effective way to save thousands of dollars a year.

So in the next 12 months interest rate are going to go up and you’re not going to be able to take advantage of the incredibly low interest rates the banks are offering. Refinancing existing loans using a fixed rate is one of the most effective way to save thousands of dollars a year.

So you only have the next 12 months to take advantage of these incredible low rates, there won’t be a better time possibly in our lifetime to obtain a loan or refinance.

Get in contact with us for a free consultation to see if you can take advantage.

by Australian Finance Planning | Aug 27, 2014 | Business, Finance, Interest Rate, Refinance

With the current interest rates being slow incredibly low you could be saving thousands a year! Have you refinanced yet?

No? Well, what are you doing?

Everyone wants to improve their cash flow and everyone sits there and says they wish they had more money to do this and that. Yet we are seeing the lowest interest rates we have seen or are likely to see in this lifetime yet not many people are flying out of their seat to refinance their loans.

Everyone wants to improve their cash flow and everyone sits there and says they wish they had more money to do this and that. Yet we are seeing the lowest interest rates we have seen or are likely to see in this lifetime yet not many people are flying out of their seat to refinance their loans.

I don’t know about you but I’d love to save thousands a year. If your Boss came to you and said I would like to offer you a $10,000 pay rise would you be happy? I hope so, and that is potentially what you could be saving by refinancing.The Current fixed rate will allow you to take advantage of these incredibly low rates for years to come. So I ask again why you haven’t considered refinancing?

We offers free loan comparisons for anyone to see if you could save thousands, all our services are free of charge and we would love to help. Get in contact with us today.

More about Refinance here

So in the next 12 months interest rate are going to go up and you’re not going to be able to take advantage of the incredibly

So in the next 12 months interest rate are going to go up and you’re not going to be able to take advantage of the incredibly

Everyone wants to improve their cash flow and everyone sits there and says they wish they had more money to do this and that. Yet we are seeing the lowest interest rates we have seen or are likely to see in this lifetime yet not many people are flying out of their seat to

Everyone wants to improve their cash flow and everyone sits there and says they wish they had more money to do this and that. Yet we are seeing the lowest interest rates we have seen or are likely to see in this lifetime yet not many people are flying out of their seat to